How to File KRA Nil Returns on iTax Portal in Kenya.

This is a step-by-step guide on how to file KRA Nil returns on the iTax Portal.

It is that time of year when every Kenyan taxpayer rushes to file his or her KRA Returns on the iTax Portal. So, whether working or unemployed, everyone is rushing to file their tax returns for the previous year before the June 30th deadline.

So, in this write-up, I’ll walk you through the steps you’ll need to take if you need to file your KRA Nil Returns on the iTax Portal. This post will be quite useful to those who are unemployed or, in certain cases, students. If you are employed, you should read How To File KRA Returns Using P9 Form.

Before we begin, it is vital to understand that any Kenyan with a KRA PIN is required to file his or her iTax Returns by the deadline. So, whether you are employed or unemployed, as long as you have a KRA PIN Number, you must file KRA Returns, and failing to do so would result in a penalty from Kenya Revenue Authority (KRA).

Anyone with an active KRA PIN Number and no income is required to file KRA Nil Returns between January 1st and June 30th of each year. So, forget the outdated concept that KRA Returns are only for individuals who are employed.

What Are KRA Nil Returns?

KRA Nil Returns applies to people who do not have a source of income, also known as the unemployed. In the sense that the taxpayer does not receive money from rental, business, or employment.

Keep in mind that every Kenyan with a valid KRA PIN is required to register their annual income by June 30th of the following year. Taxpayers will file KRA Nil Returns for 2021 in 2022.

Please be advised that the penalty for late submission of individual returns has been increased to Kshs. 2,000. This is spelled out in the 2018 Finance Act. If you are employed, you must file KRA Returns with your P9 Form. You can read the detailed instructions on How To File KRA Returns If Employed Using KRA P9 Form.

If you are unemployed, you can file KRA Nil Returns as explained in the step-by-step process in this blog post. We are filing the KRA Nil Returns for the year 2021 in 2022. As a result, the Return From and Return To Date will be from January 1, 2021 – to December 31, 2021. (KRA Nil Returns 2021).

How do I file my KRA nil returns online?

It is critical that if you have an active KRA PIN on iTax, you file your KRA Returns every year between January 1st and June 30th. These dates are critical to remember if you want to be a tax-compliant Kenyan. The date for filing KRA Nil Returns this year is June 30th, 2022.

According to the Tax Procedures Act, if a return is not submitted by the due date, a penalty would be applied. Avoid Kenya Revenue Authority (KRA) penalties by filing your KRA Nil Returns online today with ease and convenience.

Requirements For Filing KRA Nil Returns 2022

To file your KRA Nil Returns on iTax, you must have your KRA PIN Number and KRA iTax Password with you. Before we begin the various processes, please verify that you have the following two items on hand:

- Your KRA PIN Code

- Your KRA iTax login passcode

How do I reset my KRA password?

If you know your KRA PIN but not your iTax password, you can request a password reset through the iTax site. Your registered email address will receive a new password (unless you don’t know your email address: Gmail, Yahoo, or Outlook).

We can begin the process of filing KRA Nil Returns 2022 now that you have everything ready. These are the returns for the fiscal year that concluded on December 31, 2021. Assuming you now have everything, namely your KRA PIN number and iTax Password, we may begin the process of How to File KRA Nil Returns on iTax.

Step By Step Guide On How to File KRA Nil Returns In 2022

Step 1: Visit KRA iTax Portal

The first step in filing KRA Nil REturns is to go to the KRA Portal, also known as the iTax Portal. Log in to your iTax account at https://itax.kra.go.ke/ KRA-Portal using your KRA PIN number and iTax Password.

Step 2: Log Into KRA iTax Dashboard

After successfully logging into your iTax account (iPage), you should see a dashboard with various features. You can complete a variety of things online with your iTax account, but this blog post will primarily focus on KRA Returns.

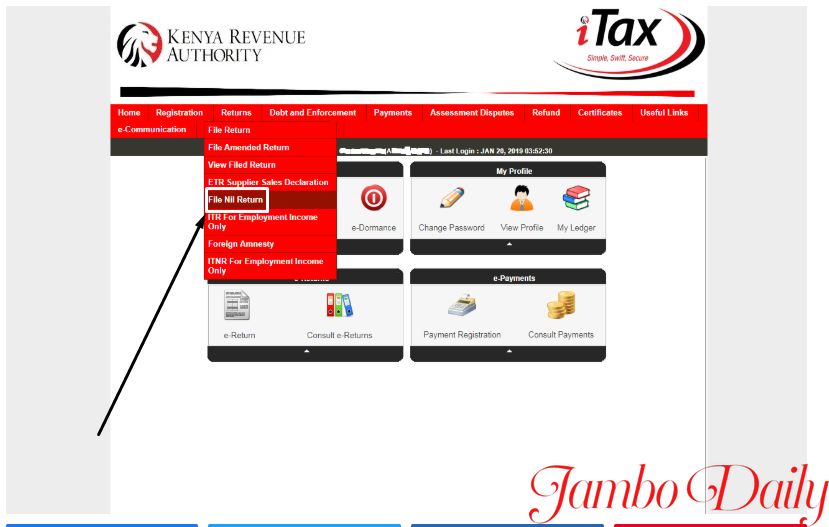

Step 3: Click On File KRA Nil Returns Tab

Click on Returns in your iTax account’s top panel menu, then click File Nil Return.

Step 4: Select The KRA Nil Return Form

Select Self in the type section. It will fill in your KRA PIN Number as well as your Tax Obligation – Income Tax Resident. To proceed, click Next.

Read How to apply for NHIF, Packages, and Requirements

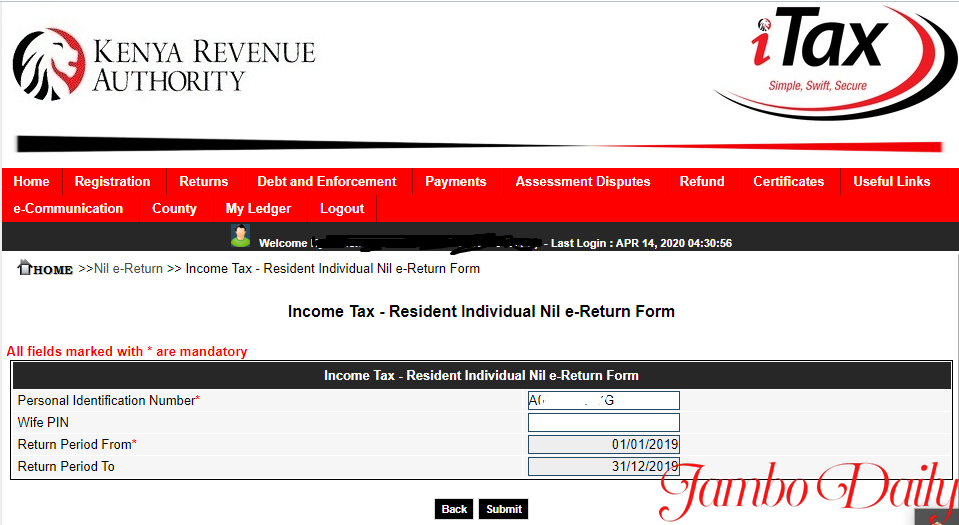

Step 5: Fill The Income Tax – Resident Individual Nil e-Return Form

The return period is chosen in this section. Because we are reporting KRA Nil Returns for the preceding year 2021, our return period will run from January 1, 2021, to December 31, 2021. The return period will automatically autofill. To proceed, click the submit button.

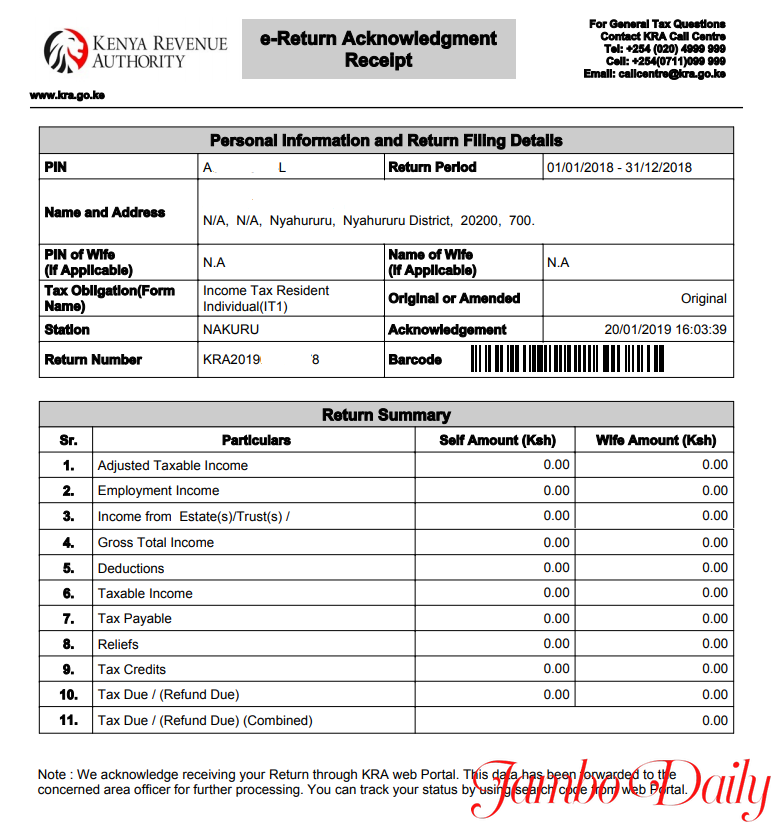

Step 6: Download KRA Nil Returns Acknowledgement Receipt

After successfully submitting your KRA Nil Returns, a return receipt with an acknowledgment number will be generated. Download and print a copy of the returns receipt.

Step 7: Print KRA e-Return Acknowledgement Receipt

The last and last step will be to print the downloaded KRA e-Return Acknowledgement Receipt. This is your final confirmation that you successfully submitted the KRA Nil Returns for the fiscal year 2021.

Read How To Check Your CRB Status Online In Kenya.

And those are the seven essential processes for filing KRA Nil Returns on iTax. Share it with your entire family, friends, and relatives. Tell a friend to file KRA Nil Returns before June 30th, 2022.

Remember, the sooner you file your KRA Nil Returns, the better. Avoid last-minute rushes, which will result in a Kshs penalty. 2,000/= for failing to file your KRA Nil Returns.

Important to Note is that there are no extensions available for that time period.